Raw materials are at the beginning of the domestic electro chemical energy storage industry's supply chain, followed by manufacturers of essential components and system integrators, and finally end users.

In the energy storage systems, there are two primary categories of components: which are batteries and systems. A system includes a battery pack, a BMS, a PCS, and an EMS.

Large storage battery (cell + PACK + BMS) cost accounted for 67%, residential storage accounted for 35% (light storage machine), and non-photovoltaic components accounted for 49% of the total cost of the energy storage system.

Roomy warehousing About 10% of total storage costs were attributable to PCS, 23% to residential storage (after removing components for 32% of total cost), and 32% to the value of the quantity stored in the home.

Storage battery

The energy storage system's capacity is set by the battery system, which is the system's nerve centre. Since big storage batteries are also made up of a single electric core and there isn't much space for cost reduction as size increases from a technological perspective, batteries tend to play a larger role in large-scale energy storage projects.

In 2021, CATL led the world in lithium-ion battery shipments for energy storage with a share of about 25%, followed by BYD, Samsung SDI of South Korea, and LGES of South Korea.

CATL is unquestionably at the forefront of its field in China, with companies like BYD, EVE Lithium Energy, Penghui Energy, Gotion, Pylon Technology.

The energy storage BMS industry is expected to be worth close to $20 billion by 2025 due to its important role as a monitoring system for the energy storage battery system.

The requirements for a BMS for energy storage are higher than those for a car's power battery.

Automakers, battery makers, and specialized BMS producers make up the bulk of the industry at the moment. There is currently no leader in the energy storage BMS market, in contrast to the power battery BMS market, which is primarily headed by the terminal automotive factory.

Given the current state of the industry in terms of technical maturity, the absence of industry standards, and the fragmented nature of the competitive environment, the trajectory of the energy storage battery BMS market is anticipated to mirror that of the power battery BMS market.

PCS, or Power Conversion System

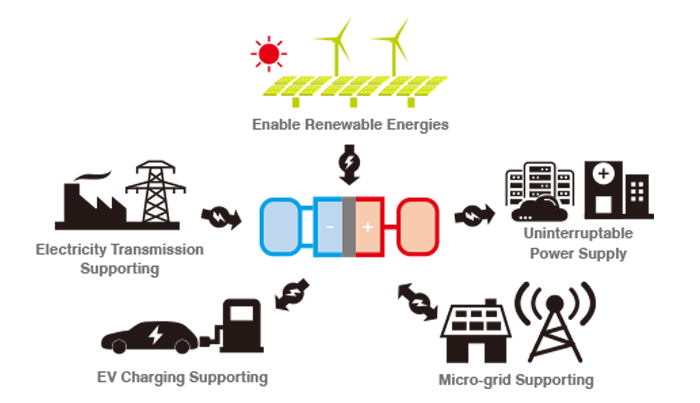

The power conversion and control system (PCS) is the core component of an energy storage power station. It regulates battery charging and discharging and performs AC/DC conversion to send power directly to AC loads when the grid is down.

PCS link prioritises proficiency in three areas: the capacity to iteratively reduce costs; the strength of the brand; and the ability to raise capital and open new channels.

Late entrants will find it difficult to make a dent in China's energy storage converter industry, which is still in its infancy in terms of quality improvement, cost cutting, and scale growth.

There is a great deal of overlap between the technologies used by the top converter manufacturers in the fields of energy storage and photovoltaic.

EMS

As the nerve centre of the energy storage network, the EMS (Energy Management System) is responsible for making important operational decisions.

The EMS allows the ESS to take part in "source-grid-load-storage" interaction, virtual power plant scheduling, and grid scheduling.

There are now roughly 16 businesses in the domestic energy storage EMS industry, including a few that are listed on the stock market that focus primarily on the State Grid system.

Mainly comprising Pylon Technology, Guodian Nanrui, Zhongtian Science and Technology, Zhongheng Electric, XuJi Electric, PingGao Electric, Sungrow and ChangYuan Group.

Capabilities in software development and energy optimization strategy design will be crucial to EMS's future core competitiveness.

Fire prevention and temperature regulation in energy storage

Energy storage temperature control mostly focuses on large-scale energy storage.

With its massive capacity, complicated operating environment, and other characteristics, liquid cooling is anticipated to increase its share of the market for large-scale energy storage.

About 3% of the total cost of an energy storage system goes towards fire safety measures; this percentage is likely to expand in tandem with the energy storage industry, and its value and volume growth are projected to outpace the market overall. A few examples of energy storage fire businesses include Green Bird Fire, National Security, and others.

There is a competitive relationship between domestic energy storage integrators and overseas integrators. However, some overseas integrators rely on OEM services provided by domestic integrators as a means of breaking into the U.S. energy storage market.

Integrators of power equipment business layouts also have certain inherent benefits. Large storage as a new element of the power system, the need for power-related technological deposits, and power equipment businesses have power-related "gene" so the transition is reasonably seamless, the future is expected to fast cut, and has stronger competitiveness.

Businesses that use electricity producing equipment have a consumer base thanks to State Grid South.

With the ground photovoltaic demand starting to rise in 2022, energy storage bidding and installation will steadily speed, considerably improving the project economy.

Domestic big storage is predicted to usher in the rapid development in tandem with the trend of new energy generation, in the mandated distribution of storage + shared storage, and other new modes of pull.

As the price of large-scale storage continues to drop throughout the world, we should expect to see a surge in demand from countries like the United States.